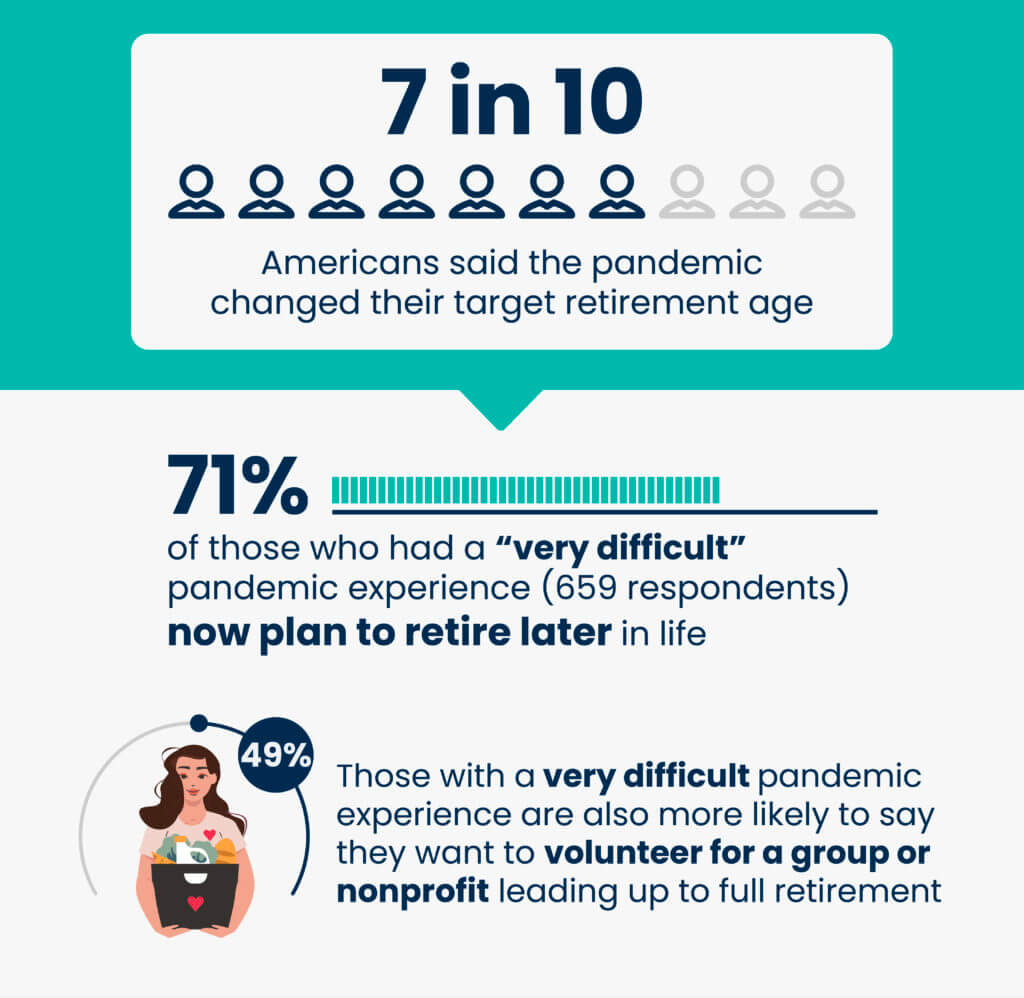

NEW YORK — A new poll of 2,002 U.S. adults between ages 35 and 70 shows that the pandemic had far-reaching effects on how employees are planning both their retirement and “pretirement” – a new life stage serving as a transition period between full-time work and retirement.

The survey split respondents by how they would describe their pandemic experience on a five-point scale, from “very easy” to “very difficult.” It found that 71 percent of those who had a “very difficult” time (659 respondents) now plan to retire later in life. People who rated their pandemic experience as “very difficult” were also more likely to aim to volunteer for a group, nonprofit, or other organization leading up to full retirement (49%).

Two-thirds of all respondents say they had a somewhat or very difficult time during the pandemic.

The survey was conducted by OnePoll, the market research division of SWNS, and was commissioned by Human Interest, a provider of 401(k) and 403(b) plans. It highlighted critical ways that workers have changed their attitudes about the retirement experience. Roughly one in three say the pandemic has changed everything about their retirement decisions — how they save (31%), what they want to do (31%), and when they want to retire (29%). An even greater number believe COVID changed how they make health decisions (40%) and how they save for emergencies (42%).

Retirees changing the definition of retired

More than nine out of 10 workers are open to switching fields or jobs during pretirement.

Small and medium-sized business (SMB) employees say they were more affected by the pandemic than those working for large companies. In fact, 72 percent of those working at organizations with 250 to 499 employees say they will now retire later than planned, 35 points higher than those working at large companies (1,000 employees or more).

READ: 401k Plans: Ultimate Beginner’s Guide For Work-Sponsored Retirement Account

Even the idea that work stops in retirement seems to be in question — the survey found that the average person believes you can work up to 11 hours a week and still consider themselves retired. Sixty-nine percent believe retirement is a gradual change away from full-time paid work, rather than a complete stop or a full transition to leisure.

The research also showed major differences in how people are planning their pretirement stage of life.

Two-thirds (66%) of those who had a very difficult pandemic experience think the ideal pretirement age is before 50. Less than a quarter (24%) of those who had a neutral pandemic experience said the same.

Retirees going into politics?

Workers have a diverse set of reasons for transitioning into a new job or industry before retirement. Looking to earn money and make their savings last longer (40%) and wanting to do something impactful for their community (39%) are at the top of the list. The coming election may be top of mind for nearly a quarter (24%) of the respondents who want to run for office when they retire. Those who had a very difficult pandemic experience are even more politically engaged — 34 percent want to run for office.

“With the pandemic’s after-effects and ongoing inflation, people have had a revelation about retirement,” says Eric Phillips, Senior Director, Partnerships & Strategic Insights at Human Interest, in a statement. “That includes ‘pretirement,’ as well, so it’s more important than ever to keep both one’s financial present and future in mind.”

READ: Where To Invest For Retirement To Successfully Grow Your Nest Egg

“In the past three years, 42 percent of employees with a retirement benefit at work say they saw their employer contribution get cut,” Phillips adds. “Employers wanting to avoid another Great Reshuffle could prioritize flexible retirement plans that can make it simple for employees to save for their future. That move may retain more employees and make it easier for businesses to navigate around whatever future challenges there are, whether that’s economic conditions, new workforce trends or other macro changes.”

Mobility is a key desire for those planning retirement. Only 21 percent would stay where they are currently living — the rest are split between moving to another city in the same state (31%), moving to a different state (25%), becoming nomadic (10%), and moving to another country (11%).

Survey Methodology:

This random double-opt-in survey of 2,002 Americans ages 35–70 was commissioned by Human Interest between September 26 and October 4, 2022. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).