NEW YORK — Nearly half (48%) of Americans claim they’re prepared for the worst when it comes to their homes. Yet, out of the 2,000 homeowners polled, 65 percent of policyholders admit they have no idea what their home insurance actually covers.

A majority (53%) say they live in a natural disaster-prone area and two in three are willing to go the extra mile to protect their homes from potential catastrophes, even if that means paying more for home insurance. Respondents believe the most important coverage to have on a home nowadays includes fire damage protection (39%), storm damage protection (35%), and coverage for personal valuables (35%).

Commissioned by Goosehead Insurance and conducted by OnePoll, the study found a disconnect between what homeowners understand about their risk and how it’s covered in their home insurance policy.For example, nearly four in five (79%) have read their home insurance policy in full. Close to a third (30%) say they actually read their policy “frequently.”

However, when asked what insurance-related terms they understand, 16 percent don’t know the meaning of any insurance terms. Commonly misunderstood terms include “limits of liability,” (35%), “home insurance replacement costs” (33%), “actual cash value” (32%), “blanket coverage” (27%), and “other structure coverage” (26%).

Likewise, 43 percent of homeowners don’t understand how percentage deductibles are applied to policies, nor how they’re calculated.

Not all home insurance claims go through

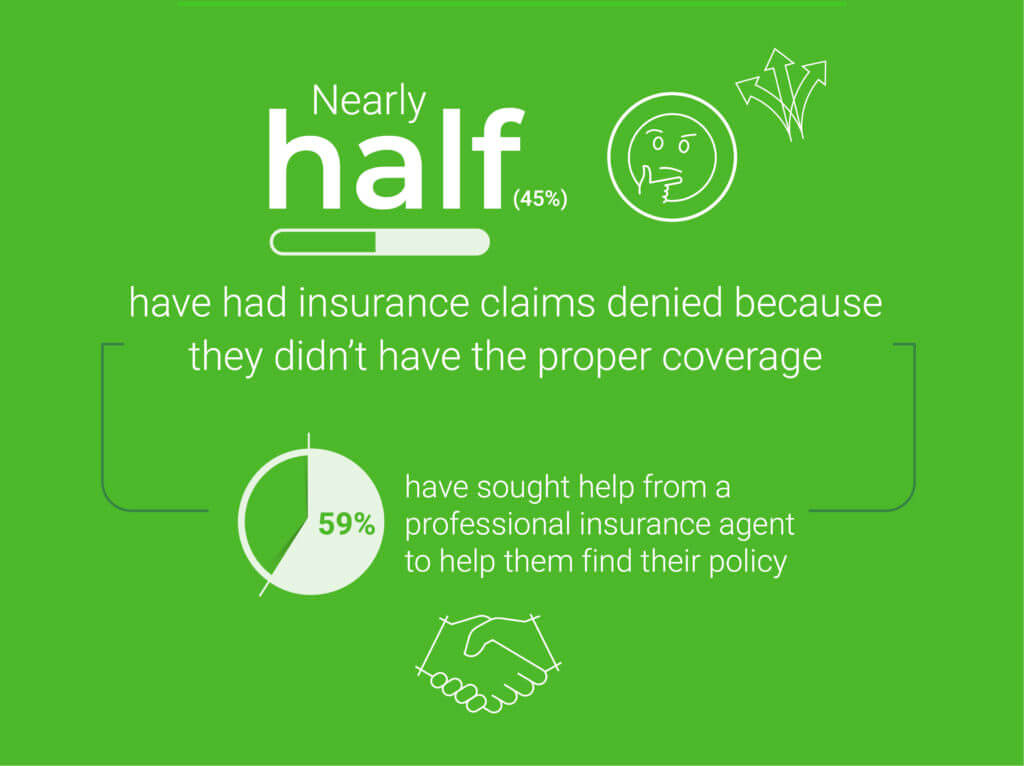

Nearly half (45%) have had insurance claims denied because they didn’t have the proper coverage.

Given this discrepancy, it’s no surprise that when looking for insurance policies, 59 percent have sought help from a professional insurance agent to help them find their policy. The most stressful parts of the process include hard-to-read policies (31%), the number of options to choose from (19%), and poor communication (18%).

“While looking for the right home insurance can be time-consuming, hard, and frustrating, it is one of the most important choices a homeowner will make,” says Brian Pattillo, Vice President at Goosehead Insurance, in a statement. “Making sure your home and belongings have the proper coverage in a worst-case scenario can make all the difference in the world. The best way to get it done is to do research and talk to people who are experts to make the process simple, transparent, and efficient.”

The average homeowner looked at four different providers before choosing their current insurance policy. The most important factors were the coverage type (26%), the insurance brand’s name (22%), and the price of the policy (18%).

When it comes to price, 57 percent would willingly sacrifice their coverage if it meant saving money due to rising rates. Three in four (76%) would also update their policy if they learned they were overpaying — something that 52 percent of respondents have found to be true.

Why should you update your policy?

The study also found the average policyholder looks to update their insurance after living in their home for five years.

Sixty-eight percent have had to change their policy based on major lifestyle changes like buying or selling a home (28%), major renovation projects (27%), and environmental changes (27%).

“With so many policy options available to consumers, talking to an expert to ensure you have the right coverage at the best price is one part of the solution,” Pattillo continues. “Take your time to find the right coverage for your household, and remember to occasionally take inventory of what you own in case you need to update your home insurance coverage.”

Survey methodology:

This random double-opt-in survey of 2,000 American homeowners was commissioned by Goosehead Insurance between June 22 and June 29, 2022. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).

That number is too low.