NEW YORK — As politicians tout the promise of the Inflation Reduction Act, Americans remain far from convinced it will actually work. In a collection of new polls, researchers have found that most families are preparing for a very difficult holiday season and are looking for any way to avoid paying continually rising prices.

A recent report from Quantum Metric discovered that three in four U.S. consumers have cut their spending by at least 25 percent to battle inflation. Half of these Americans (38%) have cut their daily spending in half just to make ends meet.

To get the best price they can, nearly two in five respondents (37%) wait for sales — unfortunately, even that’s not enough. Nearly half (45%) have opened up a new credit card in the last six months. This isn’t the best plan either, as 38 percent say their debt has doubled by doing this.

With many parents going back-to-school shopping and others getting ready for the holidays, the poll also found that four in 10 consumers are trying to put off paying for their goods as long as possible. Thirty-nine percent say they’ve been juggling multiple “buy-now-pay-later” contracts in just the last six months alone.

Labor Day woes

As Americans get ready for the last big holiday of the summer, Labor Day, many will likely only be able to afford a “stay-cation.” A recent poll by OnlineBetting.com, discovered that more than 70 percent of U.S. baseball fans won’t be able to afford a ticket to an MLB game this September.

One in three respondents have canceled plans this summer to see their favorite team play in person due to rising costs. Moreover, two in three say the extreme cost of going to the stadium keeps them from attending games.

Among the 1,009 baseball fans who took part in the survey, the place Americans think MLB teams overcharge their fans the most is in New York. The New York Yankees topped the list of the most expensive teams to see play in-person, with the New York Mets finishing fifth.

The Boston Red Sox (2nd), Los Angeles Dodgers (3rd), and Chicago Cubs rounded out the top five. Oddly enough, the overwhelming cost of entertainment in these cities doesn’t have as much to do with inflation as you might think!

Where is inflation hurting Americans the most?

A survey by WalletHub reveals that inflation is growing the slowest in New York, California, and Hawaii.

In a study of 23 major metropolitan areas, urban Honolulu (23rd), the New York City (22nd), and Boston (21st) rank at the bottom of the list for Consumer Price Index changes over the last year. Meanwhile, consumers in Anchorage, Alaska have been hardest hit by inflation. Alaskans have seen prices rise by over seven percent in the last two months. Over the last year, prices have skyrocketed by more than 12 percent.

Phoenix (2nd), Atlanta (3rd), Seattle (4th), and Baltimore (5th) have also seen the Consumer Price Index rise by more than 10 percent in 2022. So, is there anything that can slow this economic crisis down? WalletHub researchers spoke to the experts to find out if U.S. policymakers will be able to fix the economy.

“The current inflation rate tells us that our past policy was too aggressive. We did not know at the time. The COVID pandemic was unique and policymakers can be forgiven for throwing everything plus the kitchen sink at saving the economy. Now, however, we are paying the price,” says Quinnipiac University Associate Professor Christopher Ball.

“If our government continues to increase spending, it will make it harder to control inflation and eventually finance our spending with debt. That would mean higher taxes, more hardship, and slower economic growth. If instead, we keep government spending under control, taxes at least steady, and continue our current fight against inflation, then the US economy can come out the other side of the storm stronger and poised for balanced growth. We have a strong, resilient workforce and we can push forward with new technologies, greener technologies, and a wide range of innovations that improve the lives of everyone.”

Get ready for holiday hardship

Another survey of American consumers finds the public isn’t waiting for Inflation Reduction Act to eventually help low prices. Many shoppers are starting their holiday spending right now!

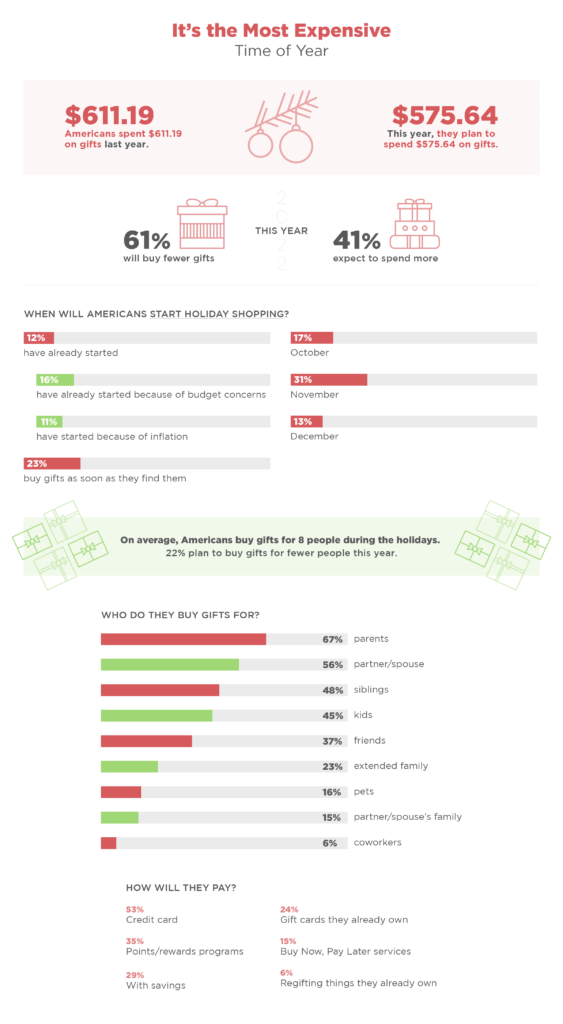

In a poll of more than 1,000 Americans, commissioned by 4over, 81 percent say they’ll be shopping during Black Friday and Cyber Monday this year. Interestingly, 57 percent of these Americans admitted they usually don’t shop during these events — but inflation is now changing all of that.

Overall, 59 percent say they’re feeling the stress of needing to buy gifts this holiday season. Three in four expect prices to continue to rise, regardless of government policies. That’s also a deal breaker for many shoppers this fall, as 47 percent say they refuse to pay full price for gifts this year.

More than half the poll (56%) are starting their holiday shopping this Labor Day! Another 12 percent say they’ve already started checking family members off their lists. Seventeen percent plan to start shopping in October and 31 percent plan to wait for November deals.

For those using credits cards to pay for holiday gifts, keep an eye on rising interest rates.

“Eventually, higher interest rates will restrict demand and will bring down inflation. Unfortunately, it is difficult for the Federal Reserve to determine exactly how much and how fast interest rates need to rise so there is a risk that too much, too quick will decrease demand too much and cause a recession,” explains Ann Owen, chair of the Department of Economics at Hamilton College.

Cities Where Inflation is Growing The Most

| Overall Rank | MSA | Total Score | Consumer Price Index Change (Latest month vs 2 months before) |

Consumer Price Index Change (Latest month vs 1 year ago) |

|---|---|---|---|---|

| 1 | Anchorage, AK | 100.00 | 7.10% | 12.40% |

| 2 | Phoenix-Mesa-Scottsdale, AZ | 68.38 | 3.10% | 12.30% |

| 3 | Atlanta-Sandy Springs-Roswell, GA | 56.22 | 2.40% | 11.50% |

| 4 | Seattle-Tacoma-Bellevue, WA | 50.51 | 3.20% | 10.10% |

| 5 | Baltimore-Columbia-Towson, MD | 50.13 | 2.60% | 10.60% |

| 6 | Miami-Fort Lauderdale-West Palm Beach, FL | 49.36 | 2.50% | 10.60% |

| 7 | Houston-The Woodlands-Sugar Land, TX | 48.28 | 2.80% | 10.20% |

| 8 | Detroit-Warren-Dearborn, MI | 45.58 | 3.00% | 9.70% |

| 9 | Tampa-St. Petersburg-Clearwater, FL | 45.22 | 1.30% | 11.20% |

| 10 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | 32.57 | 2.30% | 8.80% |

| 11 | St. Louis, MO-IL | 29.95 | 2.40% | 8.40% |

| 12 | Dallas-Fort Worth-Arlington, TX | 27.65 | 1.00% | 9.40% |

| 13 | Riverside-San Bernardino-Ontario, CA | 26.73 | 1.10% | 9.20% |

| 14 | Chicago-Naperville-Elgin, IL-IN-WI | 26.42 | 1.50% | 8.80% |

| 15 | Denver-Aurora-Lakewood, CO | 22.87 | 1.70% | 8.20% |

| 16 | Minneapolis-St.Paul-Bloomington, MN-WI | 19.02 | 1.20% | 8.20% |

| 17 | Los Angeles-Long Beach-Anaheim, CA | 12.48 | 0.90% | 7.70% |

| 18 | Washington-Arlington-Alexandria, DC-VA-MD-WV | 12.32 | 1.10% | 7.50% |

| 19 | San Diego-Carlsbad, CA | 11.40 | 1.20% | 7.30% |

| 20 | San Francisco-Oakland-Hayward, CA | 11.00 | 1.70% | 6.80% |

| 21 | Boston-Cambridge-Newton, MA-NH | 5.01 | 0.70% | 7.00% |

| 22 | New York-Newark-Jersey City, NY-NJ-PA | 3.85 | 1.10% | 6.50% |

| 23 | Urban Honolulu, HI | 2.54 | 0.60% | 6.80% |