NEW YORK — How much do you need to make in order to really feel like you’re in a good spot in life? The average American says “financial independence” means making upwards of $94,000 per year, and 60 percent feel optimistic they can reach this milestone.

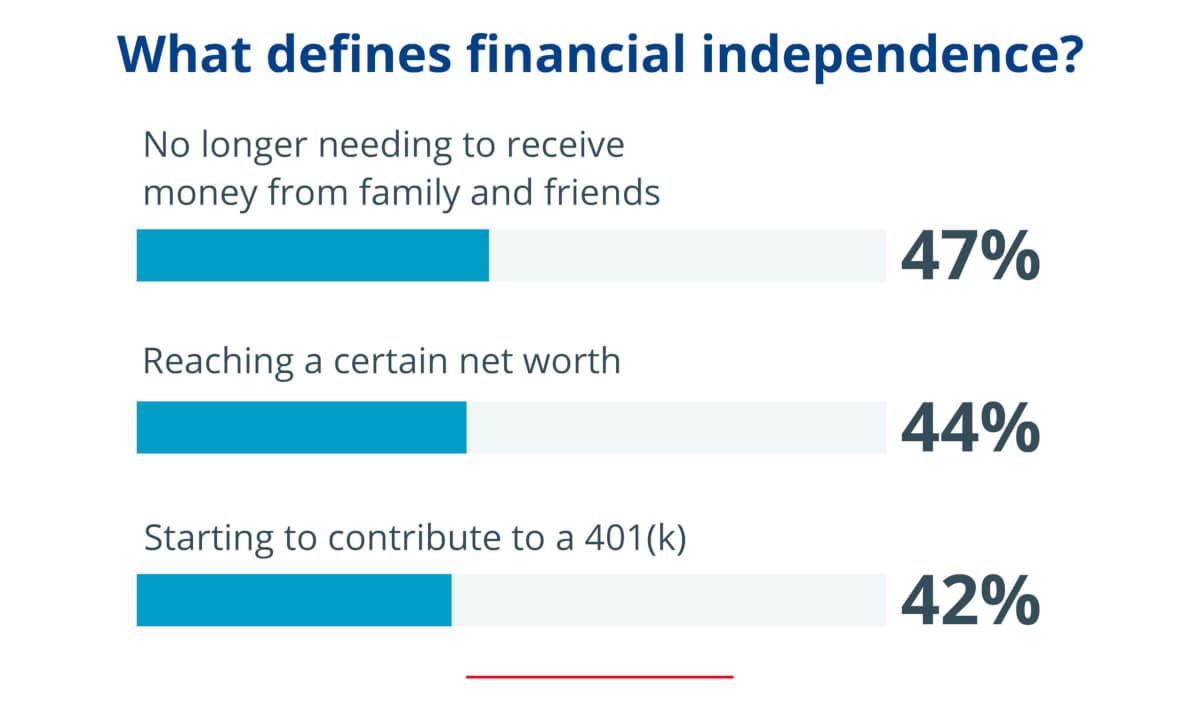

In a recent poll of 2,000 adults, spenders and savers say financial freedom is synonymous with resilience and independence: not needing money from family and friends (47%), reaching a certain net worth (44%), and contributing to a 401(k) (42%). The new study by financial services company Empower, conducted by OnePoll, also reveals that more than two in five define “making it” as reaching financial independence (44%).

Doing so is important to 67 percent of Americans, though nearly a quarter (24%) say they haven’t yet achieved it. Definitions of success extend beyond Americans’ wallets to the workplace by moving up in their career (39%) and having a job they love (37%).

Despite having financial aspirations for the future, a majority of people (72%) admit they currently stress over their finances at least once per month, and nearly one in five (17%) say they worry about money daily.

Over half (57%) of Americans say they still rely on their family and friends for financial support, especially for help paying their rent (62%), internet and streaming services (56%), and their phone bill (54%). Of those who don’t feel financially independent, three in 10 (31%) are optimistic they will be in the future, while 54 percent don’t think they’ll ever be able to pay their bills without help. The majority (92%) of financially independent Americans say they only started to feel that way once they reached the age of 36.

“No matter your age, financial independence starts with clarity,” says spokesperson Keith Jones, a senior financial professional with Empower, in a statement. “Ask yourself what you want and why you want it. Establishing clear financial goals provides both direction and purpose, motivating you to work toward a more secure and satisfying financial future.”

The poll finds many parents believe their kids should be able to pay their own bills and expenses by the time they reach age 23. Of those with adult children aged 20 or older, two in five (40%) parents surveyed currently support them financially, more than half (53%) are dipping into their retirement savings to do so, and 49 percent say they live with their children to help manage expenses.

More than half of parents regret not having more money conversations with their children while they were growing up (57%). If they could turn back the clock and do things differently, 60 percent would have made financial literacy a priority.

Survey methodology:

This random double-opt-in survey of 2,000 general population Americans was commissioned by Empower and fielded by market research company OnePoll between December 11 and December 12, 2023. OnePoll team members are part of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).

Why doesn’t IRS & FBI target illegal gambling & proceeds

i would be happy with 250 a day ,will work for cash construction laborer