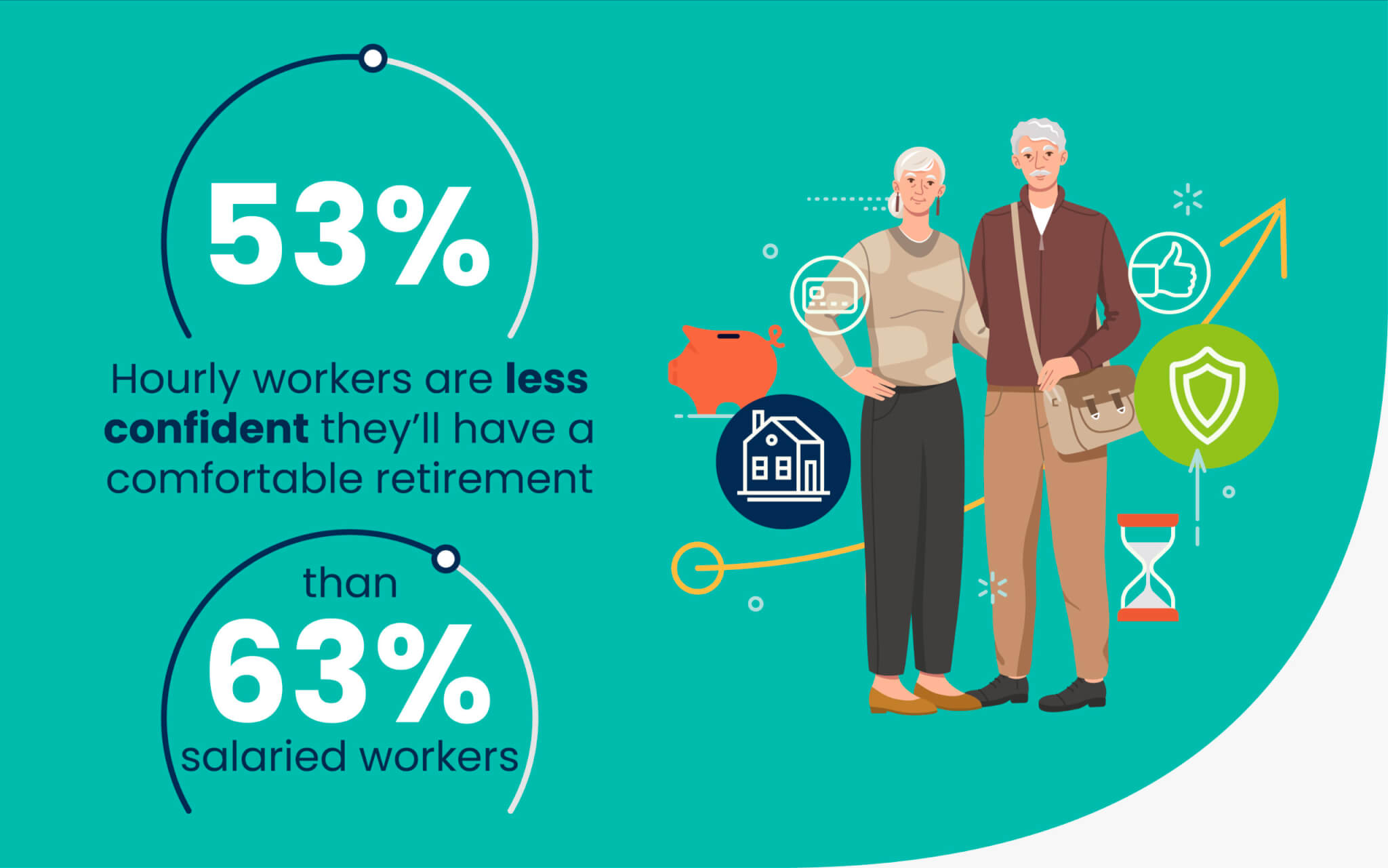

NEW YORK — Only half of hourly employees feel they will be able to retire comfortably. A survey of 2,000 employees split evenly between salaried and hourly workers reveals that hourly workers are less confident they will retire comfortably compared to salaried workers (53% vs. 63%).

Among hourly workers, one in three (33%) admit they are “winging it” when it comes to their retirement plan. Conducted by OnePoll on behalf of retirement benefits provider Human Interest, the survey finds that a quarter of employees say their employer does not offer a retirement savings plan at all.

Hourly workers making less than $60,000 a year have even less access than salaried workers making the same amount (28% with no access for hourly workers vs. 21% for salaried workers).

That lack of access may impact workers’ financial independence during retirement years. In fact, 54 percent of hourly workers say they will be somewhat or very reliant financially on a family member. Compared to salaried workers, hourly workers are twice as likely to say they do not have any other family member they can rely on.

The average worker is only saving 70 percent of what they plan to withdraw annually every year in retirement. While the average employee currently has $128,815 saved for retirement, they anticipate needing to withdraw $184,850 annually upon retiring.

In addition to these challenges, many hourly workers are the first in their families to have access to retirement savings. Nearly a third (32%) of hourly workers say their parents and grandparents did not have access to retirement savings plans, compared to 24 percent of salaried employees. Some workers are delaying or omitting certain purchases in favor of funding their retirement, including home improvements/repairs (48%), a vacation (45%), and even a wedding (39%).

Even considering all these retirement savings access challenges, a strong majority (73%) of workers are likely to embrace “pretirement.” This is an emerging life stage between full-time work and retirement in which hours are reduced and people consider new job roles. Of those planning to “pretire,” 39 percent expect to pivot to a new job in a different industry.

“Both hourly and salaried workers seek flexibility and choices in retirement planning, but we’ve seen that hourly workers overwhelmingly lack access to plans in the first place,” says Chief Experience Officer at Human Interest, Kristina Wallender, in a statement.

Men are much more confident they can comfortably retire compared to women (66% vs. 51%), an indication of pay equity gaps and fewer savings opportunities for women.

More men are likely to pretire than women (79% vs. 67%). This may be a result of the gender savings gap. Fifty-two percent of women have currently saved less than $100,000 for retirement, compared to 45 percent of men.

“Our survey found that four out of every 10 people find it hard to talk about saving for retirement with anyone other than a spouse,” adds Wallender. “We need to bring the conversation about saving for retirement out in the open so that talking about it becomes a social norm.”

Survey methodology:

This random double-opt-in survey of 1,000 salaried and 1,000 hourly employed Americans was commissioned by Human Interest between July 27 and July 31, 2023. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).